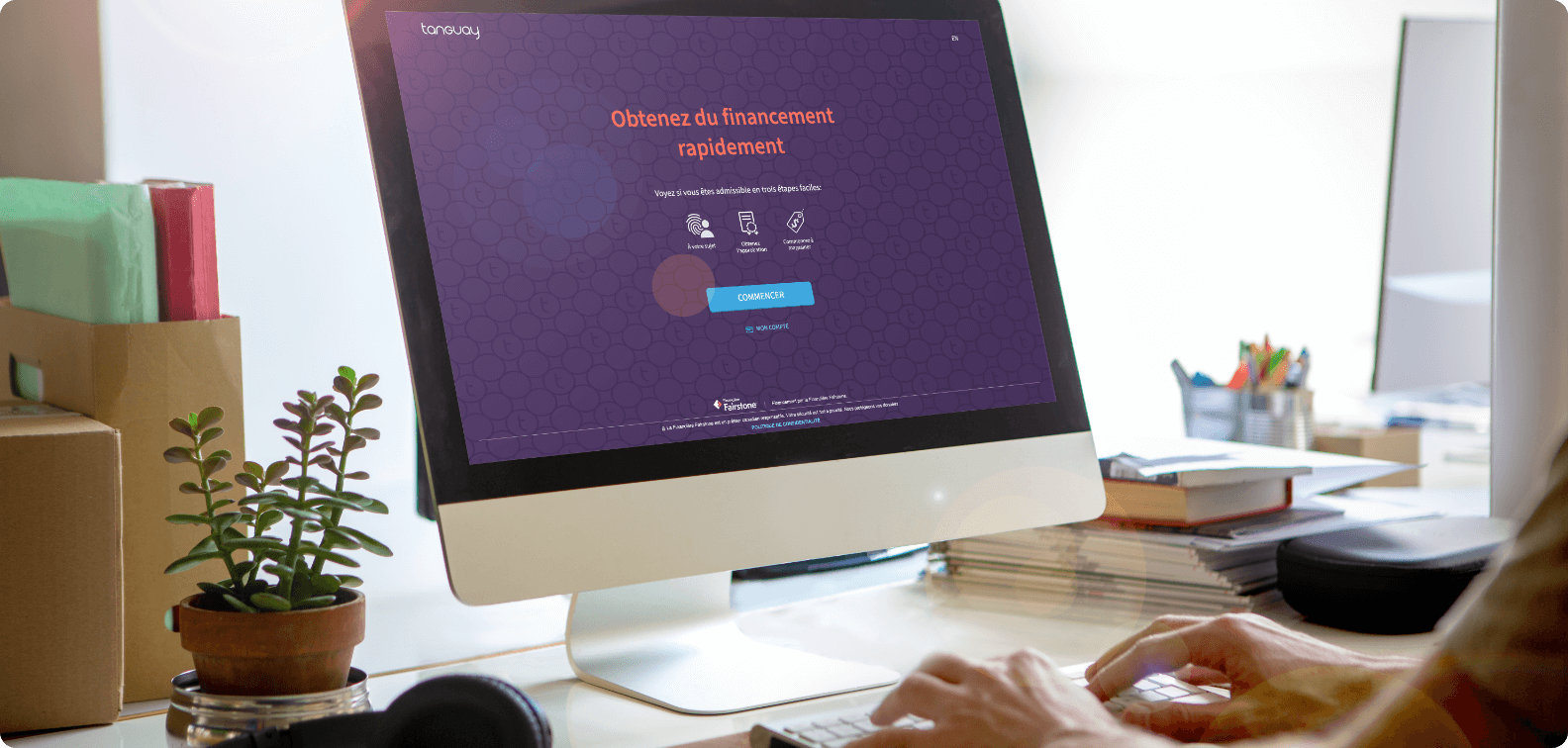

Fairstone Financing at Tanguay

Ease of Purchase for All Your Needs

At Tanguay, we understand that your purchases represent long-lasting and significant investments. That’s why the financing solutions offered at Tanguay are flexible, accessible, and tailored to your needs!

How do we make your purchases easier? Through our partnership with Fairstone Financial, one of the leaders in financing in Canada.

Why choose Fairstone financing at Tanguay?

Three words: Accessibility. Flexibility. Simplicity.

- Accessibility: Enjoy financing plans tailored to all budgets.

- Flexibility: Choose the option with terms that suit your financial situation.

- Simplicity: Get fast and easy approval thanks to our simplified credit application process.

For the trust, security, and personalized assistance offered by a Canadian company specializing in financing solutions for nearly a century.

Benefit from the expertise of Tanguay and Fairstone Financial, two companies renowned for their customer service and reliability. Additionally, ensure the increased availability of our teams to guide you in choosing the financing option that suits you best.

*Financing is offered by Fairstone Financial Inc. and is subject to credit approval. Purchases charged to approved credit accounts are subject to the terms indicated in the account documents. Additional fees and taxes may apply.

Discover the Benefits

Recognized for its commitment to helping Canadians make their purchases through flexible and transparent credit options, Fairstone Financial offers several advantages that allow us to offer you advantageous financing solutions that match your reality.

Here are all the benefits of financing with Fairstone Financial at Tanguay:

- Quick approval*

- Flexible payment plans

How does it work?

- After choosing your products, apply for financing by filling out a credit application form online, in-store, or by texting "tanguay" to 32472.*

- Receive your response quickly. Once your application is approved, receive your account number, credit limit, and make your purchase on the spot!

Apply now

Do you live outside Quebec?

Financing account FAQs

NOTE: On May 16, 2023, all former Brault & Martineau and EconoMax stores were rebranded as either Tanguay or Tanguay L’Entrepôt.

Questions about your Tanguay financing account? We’ve included answers to commonly asked questions below.

My Fairstone financing account at Tanguay

I’m a Brault & Martineau or EconoMax customer. What happens with my financing account?

Nothing. Your Brault & Martineau or EconoMax account is now rebranded as Tanguay and your account number remains the same. No action is required on your part.

Can I use my Tanguay financing account to finance purchases at Tanguay L’Entrepôt?

Yes. Your financing account from Tanguay can be used at Tanguay L’Entrepôt for both in-store and online shopping.

How do I access my Fairstone account details such as balance and payment due date?

Register or log in to get updates regarding your Fairstone financing account such as monthly electronic statements, account balance, payment due date, minimum payment, and recent transaction history.

What is my Fairstone account number? Where can I find it?

Your account number can be found in the SMS text message you received from Fairstone when you were approved for financing, on your monthly statement, or by logging into online account management.

Will I get a monthly statement?

Yes, monthly statements will be provided for active accounts.

When a monthly electronic statement is available, an email notification will be sent to the email address on file. To access your electronic statement, register or log in to online account management.

How can I get assistance with understanding my monthly statement?

Click here for an outline of the information contained in your monthly statement.

I’m currently receiving my monthly statement in the mail. Can I request monthly electronic statements instead of printed statements?

Yes. To receive monthly electronic statements, you need to register for an online account. Once you’ve created an online account, you’ll be automatically switched to receive monthly electronic statements.

I’m currently receiving my monthly statement in the mail. Can I request monthly electronic statements instead of printed statements?

Yes. To change your monthly statement preference, call Fairstone at 844-807-1301.

Will I receive a plastic card in the mail from Fairstone?

Will I pay an annual fee?

An annual fee* of $35 is applicable if you enroll in an equal payment financing plan with no interest for a term longer than 12 months. This fee is charged on your first statement and annually on your account opening anniversary date if the balance is a minimum of $1.

*Fairstone may change the fee or add other fees upon written notice and as permitted by law.

How do I make payments?

You can make payments in any of the following ways:

- Telephone or online banking (enter ‘Fairstone - Retail Financing’ as the payee)

- At your financial institution

- At a local Fairstone branch

- By mailing a cheque payable to Fairstone including the account number and the payment amount on the return portion of your mailed monthly statement addressed to:

Fairstone Financial Inc.

Attn: Payment Processing

630 René-Levesque Blvd. W. Suite 1400 Montréal, QC H3B 4Z9

Please note, Tanguay/ stores will not accept payments on Fairstone’s behalf.

When are my payments due?

Register or log in to online account management to see your payment due date. Plan expiration dates are listed in your monthly statement.

If you are not registered for online account management, your payment due date and plan expiration date are listed in your mailed monthly statement.

Are there any penalties for paying off my account balance?

No, there are no penalties for paying off your account balance, if the minimum payment is made when due and/or the account balance is paid in full by the expiration date of the promotional period. If you do not pay off your account balance within the terms of your promotional plan, you may be subject to accrued interest charges.

Will my account be closed after I’ve paid off my balance?

No. Your account will not be closed if you pay off your balance meaning you can use your available credit to finance additional purchases at Tanguay.

How do I close my account?

To close your account, contact Fairstone at 844-807-1301.

How to finance a purchase?

How do I finance a purchase at Tanguay?

- Apply for financing by completing the online financing application

- Once you’ve been approved for Fairstone financing at Tanguay, you can finance your purchase either in-store or online by following these easy steps:

-

To finance a purchase in-store:

- Log in to Fairstone online account management

- Select “Display Barcode”

- To finance your purchase, show the barcode to a Tanguay advisor

-

To finance an online purchase:

- Shop online at Tanguay, to find the items you wish to finance

- Add your items to the shopping cart

- At checkout, select ‘Fairstone Financing’ as payment option

- When prompted, enter your Fairstone financing account information

Financing plans

What financing plans are offered at Tanguay?

In partnership with Fairstone, Tanguay offers several financing plan options. Visit the Tanguay website or store to inquire about which of the following financing plans are available:

- Free Financing with 18 or 24-month terms, plus others.

- Same as cash (with payments) with 6 or 12 months, plus others (in Quebec).

To confirm which financing plan you are enrolled in, see your monthly statement.

How does the Free Financing plan work?

- The amount financed is divided over the term of the plan selected and becomes your fixed minimum monthly payment.

- Credit charges will not accrue on the purchase during the promotional period if the required minimum payment is made each billing cycle during the promotional period when due.

- If the minimum payment is not paid when due or if a balance remains after the promotional period expires, credit charges will be assessed at the APR shown in the disclosure statement.

Free financing example of credit charges:

| Financed amount |

Annual interest rate |

Interest for 30-day billing cycle |

Annual interest cost |

| $100 |

31.99% |

$2.63 |

$31.99 |

| $500 |

31.99% |

$13.15 |

$159.95 |

| $1 000 |

31.99 % |

$26.29 |

$319.90 |

How does the Same as cash (with payments) financing plan work?

- Credit charges will accrue on the purchase from the beginning of the promotional period, and minimum payments of 5% of the balance will be due each billing cycle.

- If you make the required payments and pay the financed amount in full by the expiration date of the promotional period, all of the accrued credit charges will be waived and no credit charges will be assessed on the purchase.

- If you do not pay the financed amount in full by the expiration date of the promotional period, all of the accrued credit charges will be assessed. Making only the minimum monthly payments on your account will not pay off the purchase in time to avoid Credit charges.

Same as cash (with payments) example of credit charges:

| |

Estimated accrued interest added to outstanding balance if not paid in full by end of term |

| Financed amount |

5% minimum monthly payment based on the declining monthly balance (amount below correspond to the 1st month) |

Interest if paid in full by expiry date of plan |

6-month term |

12-month term |

| $1,000 |

50 $ |

$0 |

$139,31 |

$241,71 |

| $2,000 |

$100 |

$0 |

$278,61 |

$483,42 |

| $3,000 |

$150 |

$0 |

$417,92 |

$725,12 |

Need a hand or have additional questions?

- Get updates regarding your Fairstone Financial account, such as electronic statements, account balance, payment due date, minimum payment, and more by logging in.

- Speak with a Fairstone Financial agent at 844 807-1301 Monday to Friday from 8 AM to 8 PM (EST) or use their Interactive Voice Response (IVR) system 24/7.

Living Room

Living Room  Sofas & Sectionals

Sofas & Sectionals  Sectionals & Modular Sofas

Sectionals & Modular Sofas  Sofa Beds & Sleeper Sofas

Sofa Beds & Sleeper Sofas  Ottomans, Poufs & Footstools

Ottomans, Poufs & Footstools  Armchairs and Accent Chairs

Armchairs and Accent Chairs  Accent Chairs & Armchairs

Accent Chairs & Armchairs  Bean Bag Chairs & Floor Cushions

Bean Bag Chairs & Floor Cushions  Recliner Chairs

Recliner Chairs  Massage Chairs

Massage Chairs  Multifunction chairs

Multifunction chairs  TV Stands & Media Storage

TV Stands & Media Storage  Living Room Tables

Living Room Tables  Coffee Tables

Coffee Tables  End & Side Tables

End & Side Tables  Console & Sofa Tables

Console & Sofa Tables  Nesting Tables

Nesting Tables  Living Room Benches

Living Room Benches  Electric Fireplaces

Electric Fireplaces  Living Room Sets

Living Room Sets  Kitchen & Dining Room

Kitchen & Dining Room  Dining Tables

Dining Tables  Bar table

Bar table  Dining Room Sets

Dining Room Sets  Chairs & Stools

Chairs & Stools  Dining Chairs

Dining Chairs  Bar & Counter Stools

Bar & Counter Stools  Kitchen Carts & Islands

Kitchen Carts & Islands  Bar & Wine Cabinets

Bar & Wine Cabinets  Kitchen & Dining Benches

Kitchen & Dining Benches  Bedroom

Bedroom  Bedroom Sets

Bedroom Sets  Beds & Bed Frames

Beds & Bed Frames  King Size Beds

King Size Beds  Queen Size Beds

Queen Size Beds  Full Size Beds

Full Size Beds  Twin Size Beds

Twin Size Beds  Bunk Beds

Bunk Beds  Murphy Beds & Wall Beds

Murphy Beds & Wall Beds  Headboards

Headboards  Storage Bed Drawers

Storage Bed Drawers  Dressers

Dressers  Tall Dressers

Tall Dressers  Kids Dressers & Chests

Kids Dressers & Chests  Nightstands

Nightstands  Bedroom Mirrors

Bedroom Mirrors  Makeup Vanities

Makeup Vanities  Storage & Organization

Storage & Organization  Wall Shelves & Shelving Units

Wall Shelves & Shelving Units  Cabinets & Cupboards

Cabinets & Cupboards  Bookshelves & Bookcases

Bookshelves & Bookcases  Accent Cabinets & Chests

Accent Cabinets & Chests  Display Cabinets

Display Cabinets  Home Office

Home Office  Desks & Workstations

Desks & Workstations  Office & Gaming Chairs

Office & Gaming Chairs  Filing Cabinets

Filing Cabinets  Printer Stands & Office Carts

Printer Stands & Office Carts  Lighting

Lighting  Table lamps

Table lamps  Floor Lamps

Floor Lamps  Wall lamps

Wall lamps  Pendant lightning

Pendant lightning  Bulbs

Bulbs  Cushions & Throw Blankets

Cushions & Throw Blankets  Cushions & Throw Pillows

Cushions & Throw Pillows  Throw Blankets

Throw Blankets  Rugs & Carpets

Rugs & Carpets  Large Area Rugs

Large Area Rugs  Small & Medium Rugs

Small & Medium Rugs  Hallway Runners

Hallway Runners  Round Rugs

Round Rugs  Outdoor Rugs

Outdoor Rugs  Baby & Kids Rugs

Baby & Kids Rugs  Wall decorations

Wall decorations  Canvas Wall Art & Paintings

Canvas Wall Art & Paintings  Hanging Wall Decor

Hanging Wall Decor  Wall Clocks & Table Clocks

Wall Clocks & Table Clocks  Mirrors

Mirrors  Wall Mirrors

Wall Mirrors  Floor Mirrors

Floor Mirrors  Lighted Mirrors

Lighted Mirrors  Decor Accessories

Decor Accessories  Decorative Objects & Home Accents

Decorative Objects & Home Accents  Decorative Vases & Vessels

Decorative Vases & Vessels  Candle Holders & Lanterns

Candle Holders & Lanterns  Serving Trays & Platters

Serving Trays & Platters  Bookends & Magazine Racks

Bookends & Magazine Racks  Storage Baskets & Bins

Storage Baskets & Bins  Decorative Board Games

Decorative Board Games  Decorative Ladders

Decorative Ladders  Artificial Plants & Flowers

Artificial Plants & Flowers  Flower Pots, Plant Stands & Planters

Flower Pots, Plant Stands & Planters  Ready-Made Curtains

Ready-Made Curtains  Curtain Rods & Accessories

Curtain Rods & Accessories  Wall Hooks & Coat Racks

Wall Hooks & Coat Racks  Coat Racks & Stands

Coat Racks & Stands  Wall Hooks & Hook Racks

Wall Hooks & Hook Racks  Home Fragrance & Candles

Home Fragrance & Candles  Room Sprays & Mists

Room Sprays & Mists  Essential Oil Diffusers

Essential Oil Diffusers  Christmas Shop

Christmas Shop  Christmas trees and wreaths

Christmas trees and wreaths  Festive lights and garlands

Festive lights and garlands  Mattresses

Mattresses  Foam Mattresses

Foam Mattresses  Twin Size Mattresses

Twin Size Mattresses  Twin XL Size Mattresses

Twin XL Size Mattresses  Full Size Mattresses

Full Size Mattresses  Queen Size Mattresses

Queen Size Mattresses  King Size Mattresses

King Size Mattresses  Sofa Bed & Futon Mattresses

Sofa Bed & Futon Mattresses  RV Mattresses

RV Mattresses  Mattress Foundations

Mattress Foundations  Full Size Box Springs

Full Size Box Springs  Queen Size Box Springs

Queen Size Box Springs  Adjustable Beds

Adjustable Beds  Twin XL Size Adjustable Beds

Twin XL Size Adjustable Beds  Twin Size Adjustable Beds

Twin Size Adjustable Beds  Full Size Adjustable Beds

Full Size Adjustable Beds  Queen Size Adjustable Beds

Queen Size Adjustable Beds  King Size Adjustable Beds

King Size Adjustable Beds  Pillows & Bedding

Pillows & Bedding  Bed Sheets & Sheet Sets

Bed Sheets & Sheet Sets  Twin Size Bed Sheets

Twin Size Bed Sheets  Full Size Bed Sheets

Full Size Bed Sheets  Queen Size Bed Sheets

Queen Size Bed Sheets  King Size Bed Sheets

King Size Bed Sheets  Adjustable Bed Sheet Sets

Adjustable Bed Sheet Sets  Duvet Cover Sets

Duvet Cover Sets  Queen Size Duvet Covers

Queen Size Duvet Covers  Full Size Duvet Covers

Full Size Duvet Covers  King Size Duvet Covers

King Size Duvet Covers  Duvets

Duvets  Twin Size Duvets

Twin Size Duvets  Queen Size Duvets

Queen Size Duvets  King Size Duvets

King Size Duvets  Comforters

Comforters  Blankets

Blankets  Twin Size Blankets

Twin Size Blankets  Queen Size Blankets

Queen Size Blankets  King Size Blankets

King Size Blankets  Quilts

Quilts  Queen Size Quilts

Queen Size Quilts  King Size Quilts

King Size Quilts  Twin Size Quilts

Twin Size Quilts  Mattress & Pillow Protectors

Mattress & Pillow Protectors  King Size Mattress Protectors

King Size Mattress Protectors  Queen Size Mattress Protectors

Queen Size Mattress Protectors  Twin Size Mattress Protectors

Twin Size Mattress Protectors  Pillow Protectors

Pillow Protectors  Pillow Shams

Pillow Shams  Baby Nursery Furniture

Baby Nursery Furniture  Baby & Kids Bedding

Baby & Kids Bedding  Kids Blankets

Kids Blankets  Baby Crib Sheet Sets

Baby Crib Sheet Sets  Changing table

Changing table  Kids Room Decor

Kids Room Decor  Strollers, Car Seats & Baby Carriers

Strollers, Car Seats & Baby Carriers  Baby Carriers & Travel Bags

Baby Carriers & Travel Bags  Strollers

Strollers  Car seats

Car seats  High Chairs & Table Booster Seats

High Chairs & Table Booster Seats  High Chairs

High Chairs  Table Booster Seats & Floor Seats

Table Booster Seats & Floor Seats  Playpens, Playmats, Bouncers & Rockers

Playpens, Playmats, Bouncers & Rockers  Baby Playmats & Gyms

Baby Playmats & Gyms  Baby Playards & Playpens

Baby Playards & Playpens  Baby Bouncers & Swings

Baby Bouncers & Swings  Baby Feeding Essentials

Baby Feeding Essentials  Baby Dinnerware & Silicone Tableware

Baby Dinnerware & Silicone Tableware  Feeding & Nursing

Feeding & Nursing  Nursing Pillows

Nursing Pillows  Baby Bottle Sterilizers

Baby Bottle Sterilizers  Breast Pumps

Breast Pumps  Milk Dispensers

Milk Dispensers  Baby Bottle Drying Racks

Baby Bottle Drying Racks  Care and safety

Care and safety  Bath and care

Bath and care  Security gates

Security gates  Cam and monitors

Cam and monitors  Kids Toys & Games

Kids Toys & Games  Kids Electric Cars & Power Wheels

Kids Electric Cars & Power Wheels  Sensory Games

Sensory Games

Play Tents & Teepees

Play Tents & Teepees  Indoor Games for Kids

Indoor Games for Kids  Kids Kitchen Sets & Play Food

Kids Kitchen Sets & Play Food  Kids Bikes & Kick Scooters

Kids Bikes & Kick Scooters  Rocker Toys & Rocking Horses

Rocker Toys & Rocking Horses  Educational Toys

Educational Toys  Plush & Stuffed Animals

Plush & Stuffed Animals  Outdoor games

Outdoor games  Kids Furniture

Kids Furniture  Kids Storage & Room Organization

Kids Storage & Room Organization  Kids Table & Chairs

Kids Table & Chairs  Kids Play Couches

Kids Play Couches  Refrigerators & Freezers

Refrigerators & Freezers  Refrigerators

Refrigerators  Bottom Freezer Refrigerators

Bottom Freezer Refrigerators  Top Freezer Refrigerators

Top Freezer Refrigerators  French Door Refrigerators

French Door Refrigerators  4-Door Refrigerators

4-Door Refrigerators  Side By Side Refrigerators

Side By Side Refrigerators  Freezerless Refrigerators

Freezerless Refrigerators  Built-in refrigerators

Built-in refrigerators  Mini Fridges

Mini Fridges  Freezers

Freezers  Upright Freezers

Upright Freezers  Built-in Freezers

Built-in Freezers  Wine Coolers & Cellars

Wine Coolers & Cellars  Beverage Coolers

Beverage Coolers  Water Coolers & Dispensers

Water Coolers & Dispensers

Cooking Appliances

Cooking Appliances  Electric Ranges

Electric Ranges  Freestanding Electric Ranges

Freestanding Electric Ranges  Slide-In Electric Ranges

Slide-In Electric Ranges  Induction Ranges

Induction Ranges  Gas Ranges

Gas Ranges  Gas Ranges

Gas Ranges  Slide-in Gas Ranges

Slide-in Gas Ranges  Cooktops

Cooktops  Gas Cooktops

Gas Cooktops  Induction Cooktops

Induction Cooktops  Wall Ovens

Wall Ovens  Quick cooking ovens

Quick cooking ovens  Combined Wall Ovens

Combined Wall Ovens  Built-in steam ovens

Built-in steam ovens  Warming Drawers

Warming Drawers  Microwaves

Microwaves  Small microwaves

Small microwaves  Spacious microwave

Spacious microwave  Built-in Microwaves

Built-in Microwaves  Over-the-Range Microwaves

Over-the-Range Microwaves  Range Hoods

Range Hoods  Under-Cabinet Range Hoods

Under-Cabinet Range Hoods  Wall-Mounted Range Hoods

Wall-Mounted Range Hoods  Insert Range Hoods

Insert Range Hoods  Island Range Hoods

Island Range Hoods  Downdraft Range Hoods

Downdraft Range Hoods  Range Hood Parts & Filters

Range Hood Parts & Filters  Range & Stove Accessories

Range & Stove Accessories  Range Backsplashes

Range Backsplashes  Dishwashers

Dishwashers  Built-In & Integrated Dishwashers

Built-In & Integrated Dishwashers  Portable & Countertop Dishwashers

Portable & Countertop Dishwashers  Washers & Dryers

Washers & Dryers  Washers

Washers  Front Load Washers

Front Load Washers  Top Load Washers

Top Load Washers  Compact & Portable Washers

Compact & Portable Washers  Dryers

Dryers  Electric Dryers

Electric Dryers  Gas dryers

Gas dryers  Commercial Dryers

Commercial Dryers  Top Load Washer & Dryer Sets

Top Load Washer & Dryer Sets  Front Load Washer & Dryer Sets

Front Load Washer & Dryer Sets  All-in-One Washer Dryer Combos

All-in-One Washer Dryer Combos  Washer & Dryer Accessories

Washer & Dryer Accessories  Washer & Dryer Stacking Kits

Washer & Dryer Stacking Kits  Washing Machine Hoses & Dryer Vent Kits

Washing Machine Hoses & Dryer Vent Kits  Washer & Dryer Pedestals

Washer & Dryer Pedestals  Vacuum Cleaners

Vacuum Cleaners  Central Vacuum Systems

Central Vacuum Systems  Canister Vacuums

Canister Vacuums  Robot Vacuums

Robot Vacuums  Cordless Stick Vacuums

Cordless Stick Vacuums  Off Grid Appliances

Off Grid Appliances  Propane Gas Refrigerators

Propane Gas Refrigerators  Solar Powered Refrigerators

Solar Powered Refrigerators  Propane Gas Ranges

Propane Gas Ranges  Gas hobs

Gas hobs  Solar Powered Freezers

Solar Powered Freezers  Cooling & Air Quality

Cooling & Air Quality  Air Conditioners

Air Conditioners  Dehumidifiers and humidifiers

Dehumidifiers and humidifiers  Air Purifier Filters

Air Purifier Filters  Air Purifiers

Air Purifiers  Kitchen Appliance Packages

Kitchen Appliance Packages  3-Piece Appliance Sets

3-Piece Appliance Sets

Coffee Shop

Coffee Shop  Automatic Espresso Machines

Automatic Espresso Machines  Semi-Automatic Espresso Machines

Semi-Automatic Espresso Machines  Manual Espresso Machines

Manual Espresso Machines  Single-Serve Pod Coffee Makers

Single-Serve Pod Coffee Makers  Drip Coffee Makers

Drip Coffee Makers  Coffee Beans & Capsules

Coffee Beans & Capsules  Coffee Grinders

Coffee Grinders  Milk Frothers

Milk Frothers  Coffee Machine Accessories

Coffee Machine Accessories  Small Kitchen Appliances

Small Kitchen Appliances  Bowl Lift Stand Mixers

Bowl Lift Stand Mixers  Hand Mixers

Hand Mixers  Mixer Bowls & Accessories

Mixer Bowls & Accessories  Air Fryers & Deep Fryers

Air Fryers & Deep Fryers  Deep Fryers

Deep Fryers  Air Fryers

Air Fryers  Electric Cookers & Fryers

Electric Cookers & Fryers  Rice Cookers

Rice Cookers  Slow Cookers

Slow Cookers  Sous Vide Cookers

Sous Vide Cookers  Food Vacuum Sealers

Food Vacuum Sealers  Food Steamers

Food Steamers  Multi-Cookers & Instant Pots

Multi-Cookers & Instant Pots  Electric Grills, Griddles & Skillets

Electric Grills, Griddles & Skillets  Electric Griddles

Electric Griddles  Panini Presses & Sandwich Makers

Panini Presses & Sandwich Makers  Waffle & Donut Makers

Waffle & Donut Makers  Portable Cooktops & Countertop Burners

Portable Cooktops & Countertop Burners  Electric Skillets

Electric Skillets  Food Processors & Choppers

Food Processors & Choppers  Fondue Sets & Raclette Grills

Fondue Sets & Raclette Grills  Toasters & Countertop Ovens

Toasters & Countertop Ovens  Toasters

Toasters  Blenders & Juicers

Blenders & Juicers  Hand Blenders

Hand Blenders  Centrifugal & Manual Juicers

Centrifugal & Manual Juicers  Kettles

Kettles  Trash Compactors

Trash Compactors  Beverage Makers

Beverage Makers  Sparkling Water Makers

Sparkling Water Makers  Slush & Shake Makers

Slush & Shake Makers  Specialty Kitchen Appliances

Specialty Kitchen Appliances  Bread Makers

Bread Makers  Pasta Makers

Pasta Makers  Popcorn Machines

Popcorn Machines  Ice Cream Machines & Sorbet Makers

Ice Cream Machines & Sorbet Makers  Cotton Candy Machines

Cotton Candy Machines  Countertop Ice Makers

Countertop Ice Makers  Slicers, Graters & Peelers

Slicers, Graters & Peelers  Food Dehydrators

Food Dehydrators  Specialty Kitchen Tools

Specialty Kitchen Tools  Cookware & Bakeware

Cookware & Bakeware  Cookware

Cookware  Frying Pans & Woks

Frying Pans & Woks  Plates and molds

Plates and molds  Mixing Bowls

Mixing Bowls  Casseroles

Casseroles  Salt & Pepper Mills

Salt & Pepper Mills  Knives & Accessories

Knives & Accessories  Miscellaneous utensils and accessories

Miscellaneous utensils and accessories  Cutting boards

Cutting boards  Books

Books  Tableware & Dinnerware

Tableware & Dinnerware  Dinnerware

Dinnerware  Serving Bowls & Platters

Serving Bowls & Platters  Flatware & Cutlery

Flatware & Cutlery  Cups

Cups  Table Linens & Accessories

Table Linens & Accessories  Drinkware & Glassware

Drinkware & Glassware  Glasses

Glasses  Carafes & Wine Decanters

Carafes & Wine Decanters  Ice Buckets & Chillers

Ice Buckets & Chillers  Bar Tools & Accessories

Bar Tools & Accessories  Countertop Accessories

Countertop Accessories  Kitchen Trash Cans

Kitchen Trash Cans  Containers & Countertop Accessories

Containers & Countertop Accessories  Lunch Boxes & Drink Containers

Lunch Boxes & Drink Containers  Lunch Boxes & Bags

Lunch Boxes & Bags  TV & Home Theatre

TV & Home Theatre  Televisions

Televisions  80 Inch and Larger TVs

80 Inch and Larger TVs  70 - 79 Inch TVs

70 - 79 Inch TVs  60 - 69 Inch TVs

60 - 69 Inch TVs  55 - 59 Inch TVs

55 - 59 Inch TVs  46 - 54 Inch TVs

46 - 54 Inch TVs  40 - 45 Inch TVs

40 - 45 Inch TVs  30 - 39 Inch TVs

30 - 39 Inch TVs  29 Inch and Smaller TVs

29 Inch and Smaller TVs  Projectors & Projection Screens

Projectors & Projection Screens  Projectors

Projectors  All-In-One Home Theatre Systems

All-In-One Home Theatre Systems  Home Theatre Receivers

Home Theatre Receivers  Home Theatre Accessories

Home Theatre Accessories  HDMI Cables

HDMI Cables  Audio Cables & Speaker Wires

Audio Cables & Speaker Wires  Bars and surge protectors

Bars and surge protectors  Remote controls

Remote controls  Electronics Cleaners

Electronics Cleaners  Adapters & Switches

Adapters & Switches  TV Stands & Mounts

TV Stands & Mounts  TV Wall Mounts

TV Wall Mounts  Monitor mounts

Monitor mounts  AV Receiver Mounts & Frames

AV Receiver Mounts & Frames  Ceiling TV Mounts

Ceiling TV Mounts  Customizable Samsung TV Frames

Customizable Samsung TV Frames  Blu-ray Players

Blu-ray Players  Soundbars

Soundbars  Media Streaming Devices

Media Streaming Devices  Headphones, Speakers & Audio

Headphones, Speakers & Audio  Headphones & Earbuds

Headphones & Earbuds  Wired Headphones

Wired Headphones  Office Headsets

Office Headsets  Wireless Earbuds & In-Ear Headphones

Wireless Earbuds & In-Ear Headphones  Wired Earbuds & In-Ear Headphones

Wired Earbuds & In-Ear Headphones  Gaming Headsets

Gaming Headsets  Wireless Speakers & Audio Systems

Wireless Speakers & Audio Systems  Bluetooth speakers

Bluetooth speakers  Smart Speakers

Smart Speakers  Wireless Speaker Accessories

Wireless Speaker Accessories  Mini Stereo Systems & Clock Radios

Mini Stereo Systems & Clock Radios  Clock Radios

Clock Radios  AM FM Portable radios

AM FM Portable radios  Stereo Amplifiers & Receivers

Stereo Amplifiers & Receivers  Turntables & CD Players

Turntables & CD Players  CD players

CD players  Home Speakers

Home Speakers  Bookshelf Speakers

Bookshelf Speakers  Tower Speakers

Tower Speakers  Center Channel Speakers

Center Channel Speakers  Subwoofers

Subwoofers  Outdoor Speakers

Outdoor Speakers  Wall & Ceiling Speakers

Wall & Ceiling Speakers  Speaker Stands & Mounts

Speaker Stands & Mounts  Sonos Speaker Stands

Sonos Speaker Stands

Portable Music Players

Portable Music Players  Microphones

Microphones  Computers & Tablets

Computers & Tablets  Tablets

Tablets  eReaders

eReaders  Tablet cases and accessories

Tablet cases and accessories  Laptops

Laptops  Windows Laptops & Chromebooks

Windows Laptops & Chromebooks  Laptop Backpacks

Laptop Backpacks  Desktop Computers

Desktop Computers  Windows Desktop Computers

Windows Desktop Computers  Gaming Desktop Computers

Gaming Desktop Computers  All-in-One Desktop Computers

All-in-One Desktop Computers  Computer Cases

Computer Cases  Computer Monitors & Displays

Computer Monitors & Displays  Hard Drives & Storage Devices

Hard Drives & Storage Devices  USB Flash Drives

USB Flash Drives  Internal Hard Drives

Internal Hard Drives  Mice & Keyboards

Mice & Keyboards  Keyboards

Keyboards  Keyboards for gamers

Keyboards for gamers  Printers

Printers  Inkjet printers

Inkjet printers  Laser printers

Laser printers  Photo printers

Photo printers  Printer cartridges

Printer cartridges  3D Printers & 3D Scanners

3D Printers & 3D Scanners  3D Printer & 3D Scanner Accessories

3D Printer & 3D Scanner Accessories  Webcams & Microphones

Webcams & Microphones  USB Microphones

USB Microphones  Computer Speakers

Computer Speakers  Cables & Connectors

Cables & Connectors  Software

Software  Cameras & Camcorders

Cameras & Camcorders  Digital cameras

Digital cameras  Point & Shoot Cameras

Point & Shoot Cameras  Camera Lenses

Camera Lenses  Camera Flashes

Camera Flashes  Camera & Camcorder Accessories

Camera & Camcorder Accessories  Harness and fastener

Harness and fastener  Camera Accessories

Camera Accessories  Camera cases and bags

Camera cases and bags  Action Cameras & Camcorders

Action Cameras & Camcorders  Drones & RC Vehicles

Drones & RC Vehicles  Drone Accessories & Controllers

Drone Accessories & Controllers  Drones

Drones  Video Games

Video Games  Playstation

Playstation  Playstation Consoles

Playstation Consoles  Xbox

Xbox  Xbox Games

Xbox Games  Xbox Accessories

Xbox Accessories  Nintendo

Nintendo  Nintendo Consoles

Nintendo Consoles  Nintendo Games

Nintendo Games  Gaming chairs

Gaming chairs  Accessories for games

Accessories for games  Smart Home Technology

Smart Home Technology  Wireless telephones

Wireless telephones  Smart Locks

Smart Locks  Smart Thermostats

Smart Thermostats  Smart lighting

Smart lighting  Smart Plugs & Power Strips

Smart Plugs & Power Strips  Surveillance Systems

Surveillance Systems  Security Camera Accessories

Security Camera Accessories  GPS & Smartwatches

GPS & Smartwatches  Smart Watches

Smart Watches  Golf GPS & Rangefinders

Golf GPS & Rangefinders  Portable GPS Systems

Portable GPS Systems  Batteries & Chargers

Batteries & Chargers  Portable Chargers & Power Banks

Portable Chargers & Power Banks  Cellphone Chargers & Portable Chargers

Cellphone Chargers & Portable Chargers  Musical Instruments

Musical Instruments  Electronic Drum Kits

Electronic Drum Kits  BBQs & Outdoor Cooking

BBQs & Outdoor Cooking  BBQs & Grills

BBQs & Grills  Natural Gas & Propane BBQs

Natural Gas & Propane BBQs  Charcoal Grills & BBQs

Charcoal Grills & BBQs  Built-in Gas Grills

Built-in Gas Grills  Electric BBQs

Electric BBQs  Portable BBQ Grills

Portable BBQ Grills  Plancha Cooking

Plancha Cooking  Plancha Grills

Plancha Grills  Plancha Grill Accessories

Plancha Grill Accessories  Outdoor Pizza Ovens

Outdoor Pizza Ovens  Pizza ovens

Pizza ovens  Pizza Oven Accessories

Pizza Oven Accessories  Smokers & Pellet Grills

Smokers & Pellet Grills  BBQ Accessories

BBQ Accessories  BBQ Utensils

BBQ Utensils  BBQ Brushes & Cleaners

BBQ Brushes & Cleaners  BBQ Fuel & Fire Starters

BBQ Fuel & Fire Starters  BBQ Grill Parts & Accessories

BBQ Grill Parts & Accessories  BBQ Seasoning & Spices

BBQ Seasoning & Spices  Outdoor & Patio Furniture

Outdoor & Patio Furniture  Outdoor Dining

Outdoor Dining  Patio Dining Tables

Patio Dining Tables  Outdoor Dining Chairs

Outdoor Dining Chairs  Patio Conversation Sets

Patio Conversation Sets  Patio & Outdoor Sectional Sofas

Patio & Outdoor Sectional Sofas  Patio Chairs & Lawn Chairs

Patio Chairs & Lawn Chairs  Porch Swings & Gliders

Porch Swings & Gliders  Hammocks & Hanging Chairs

Hammocks & Hanging Chairs  Patio Lounge Chairs & Sun Loungers

Patio Lounge Chairs & Sun Loungers  Patio Coolers

Patio Coolers  Gazebos & Patio Umbrellas

Gazebos & Patio Umbrellas  Gazebos & Sun Shelters

Gazebos & Sun Shelters  Gazebo & Patio Umbrella Accessories

Gazebo & Patio Umbrella Accessories  Outdoor

Outdoor  Camp Stoves & Cooking

Camp Stoves & Cooking  Coolers

Coolers  Patio & Garden Decor

Patio & Garden Decor  Outdoor Lighting

Outdoor Lighting  Outdoor Lamps & Strip Lights

Outdoor Lamps & Strip Lights  Outdoor Cushions & Blankets

Outdoor Cushions & Blankets  Outdoor Rugs & Door Mats

Outdoor Rugs & Door Mats  Outdoor Planters & Flower Boxes

Outdoor Planters & Flower Boxes  Bird Houses & Feeders

Bird Houses & Feeders  Patio Heaters & Outdoor Fireplaces

Patio Heaters & Outdoor Fireplaces  Outdoor Propane Fireplaces

Outdoor Propane Fireplaces  Patio Heaters

Patio Heaters  Outdoor Fireplace Accessories

Outdoor Fireplace Accessories  Outdoor Wood-Burning Fireplaces

Outdoor Wood-Burning Fireplaces

Pool Supplies & Accessories

Pool Supplies & Accessories  Robotic Pool Cleaners

Robotic Pool Cleaners  Floating Chairs & Loungers

Floating Chairs & Loungers  Hot Tubs & Saunas

Hot Tubs & Saunas  Outdoor Saunas

Outdoor Saunas  Outdoor Hot Tubs

Outdoor Hot Tubs  Generators & Portable Power Stations

Generators & Portable Power Stations  Gas Generators

Gas Generators  Portable Power Stations

Portable Power Stations  Solar Panels & Accessories

Solar Panels & Accessories  Outdoor Power Equipment

Outdoor Power Equipment  Grass Trimmers & Weed Wackers

Grass Trimmers & Weed Wackers  Lawn Mowers

Lawn Mowers  Snow Blowers

Snow Blowers  Garage storage

Garage storage  Garage flooring

Garage flooring  Wall Organization and Accessories

Wall Organization and Accessories  Tools & Hardware

Tools & Hardware  Hand Tools

Hand Tools  Workwear & Safety Apparel

Workwear & Safety Apparel  Hose Reels & Hangers

Hose Reels & Hangers  Lifts, Jacks & Ramps

Lifts, Jacks & Ramps  Hand Tools

Hand Tools  Wrenches

Wrenches  Power Tools & Air Tools

Power Tools & Air Tools  Electric Winches

Electric Winches  Impact Drivers

Impact Drivers  Sanders & Grinders

Sanders & Grinders  Workshop Vacuums & Fans

Workshop Vacuums & Fans  Storage Sheds & Carports

Storage Sheds & Carports  Storage Shed Accessories

Storage Shed Accessories  Garages

Garages  Sheds

Sheds  Carports

Carports  Car Maintenance & Accessories

Car Maintenance & Accessories  Car Cleaning Products

Car Cleaning Products  Bathroom

Bathroom

Bathroom faucet set

Bathroom faucet set  Bathtubs

Bathtubs  Sinks

Sinks  Bathroom furniture

Bathroom furniture  Toilets

Toilets  Sink faucets

Sink faucets  Single Hole Bathroom Faucets

Single Hole Bathroom Faucets  Vessel Sink Faucets

Vessel Sink Faucets  Wall Mounted Bathroom Sink Faucet

Wall Mounted Bathroom Sink Faucet  3-Hole Bathroom Sink Faucets

3-Hole Bathroom Sink Faucets  Bath faucets

Bath faucets  Bath faucets

Bath faucets  Floor faucets

Floor faucets  Shower systems

Shower systems  Shower sets

Shower sets

Bath-shower sets

Bath-shower sets  Screens and bath doors

Screens and bath doors  Shower doors and bases

Shower doors and bases  Shower doors

Shower doors  Doors and shower panels

Doors and shower panels  Door and base assemblies

Door and base assemblies  Shower bases

Shower bases  Bathroom mirrors

Bathroom mirrors  Bathroom Accessories

Bathroom Accessories  Kitchen

Kitchen  Kitchen Faucets

Kitchen Faucets  Soap dispenser

Soap dispenser  Sports & Fitness Equipment

Sports & Fitness Equipment  GYM training devices

GYM training devices  Hockey Training Equipment

Hockey Training Equipment  Golf Training Equipment

Golf Training Equipment  Sports

Sports  Snow Sports

Snow Sports  GYM training accessories

GYM training accessories  Nautical accessories

Nautical accessories  Table Games & Board Games

Table Games & Board Games  Pool Tables

Pool Tables  Tables de Ping-Pong

Tables de Ping-Pong  Foosball & Hockey Tables

Foosball & Hockey Tables  Dartboard and cabinet

Dartboard and cabinet  Darcade games

Darcade games  Board Games

Board Games  Mobility

Mobility  Bikes

Bikes  Regular Bikes

Regular Bikes  Bicycles accessories

Bicycles accessories  Electric Go Karts

Electric Go Karts  Scooters & Skateboards

Scooters & Skateboards  Electric Skateboard

Electric Skateboard  Electric Scooters

Electric Scooters

Shaving & Hair Removal

Shaving & Hair Removal  Men's Electric Shavers & Razors

Men's Electric Shavers & Razors  Hair Care

Hair Care  Irons & Brushes

Irons & Brushes  Clothing Care

Clothing Care  Clothes Steamers

Clothes Steamers

Measurement Devices

Measurement Devices  Weighing Scales

Weighing Scales  Everything for your dog

Everything for your dog  Pet Beds & Cushions

Pet Beds & Cushions  Pet Bowls & Feeders

Pet Bowls & Feeders